Stalingrad

Eternal Poster

- Joined

- Aug 1, 2020

- Posts

- 371

- Solutions

- 10

- Reaction

- 1,094

- Points

- 287

Yow! dahil nainspired ako sa nagpost here nung about sa trading journal niya, gagawa din ako nung akin. Out of the topic, I am a nursing student but more aligned yung mind ko into business that's why I started to learn about trading. I am a scalper or a day trader, I disliked being a swing trader knowing that the market is always unpredictable, I always like to secured my profits from day to day basis. Yung reason kung bakit gusto ko ipost yung trading journal ko is para mas mamotivate ako na magjournaling (tamad eh) plus para makatulong na din sa iba, extra knowledge sa mga gusto din tahakin yung trading business.

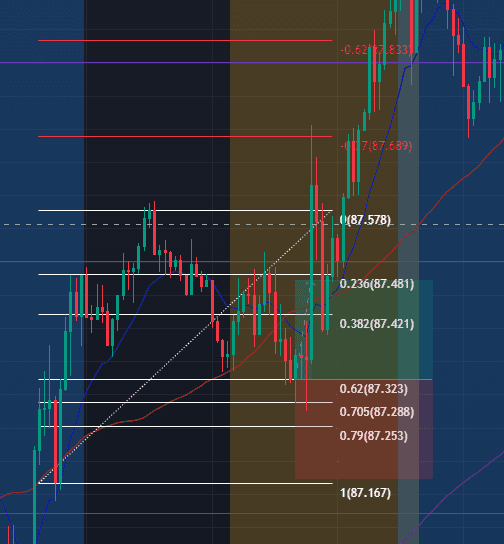

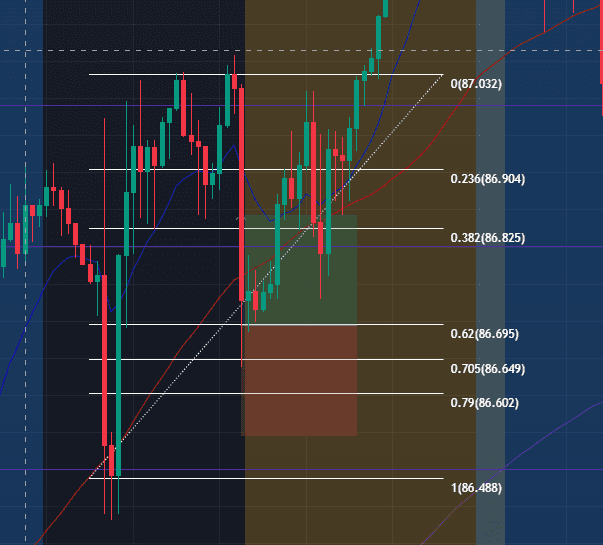

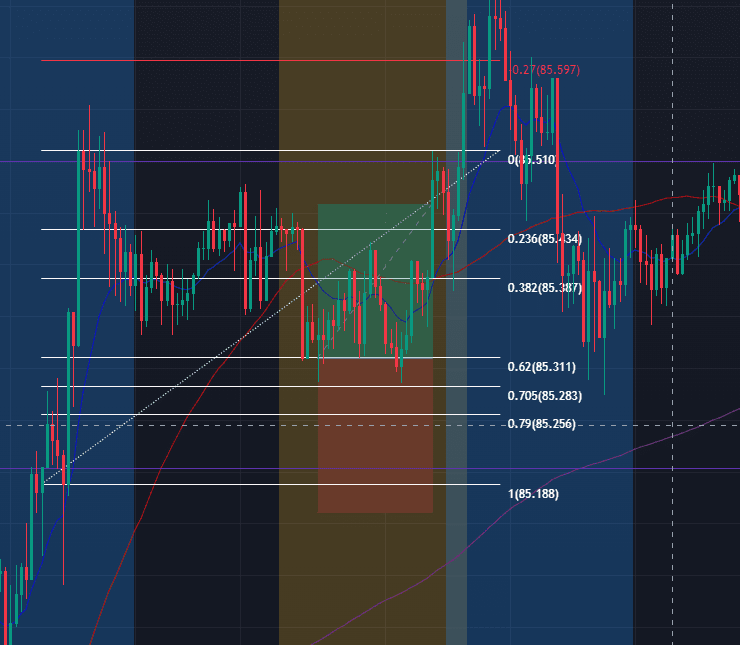

So let's proceed sa strat na gagamitin ko. I use Fibonacci Retracement plus price action sa 15M timeframe for my entry, EMA's, Market structure break, (dynamic) support and resistance, institutional levels and fractals for my confluence. My risk to reward ratio is 1:1 (using 1 lot per 3 position per trade including 1 runner) SL: 14.9 pips=105 usd in 1 lot size in a JPY pair (mandatory) 1st position TP: 14.9 pips/ 2nd position TP: Next level or S&R/ 3rd position (Runner): -0.27 or -0.62 level . Di ko pa masyadong master yung emotion ko that's why I will also take note about it during the span of 3 months.

Examples ng mga past trade ko and setups gamit yung fibs strat: (NZDJPY)

One of my rules is magtrade lang sa iisang pair which is the NZDJPY and magtrade during Asian Session (Yellow Marker). But I am a student that's why possible na makakapagtrade lang ako during London session (Blue marker). Magstart ako tommorow using Metatrader 5 Demo Account. Yon lang goodluck sakin hahahaha peace!

So let's proceed sa strat na gagamitin ko. I use Fibonacci Retracement plus price action sa 15M timeframe for my entry, EMA's, Market structure break, (dynamic) support and resistance, institutional levels and fractals for my confluence. My risk to reward ratio is 1:1 (using 1 lot per 3 position per trade including 1 runner) SL: 14.9 pips=105 usd in 1 lot size in a JPY pair (mandatory) 1st position TP: 14.9 pips/ 2nd position TP: Next level or S&R/ 3rd position (Runner): -0.27 or -0.62 level . Di ko pa masyadong master yung emotion ko that's why I will also take note about it during the span of 3 months.

Examples ng mga past trade ko and setups gamit yung fibs strat: (NZDJPY)

One of my rules is magtrade lang sa iisang pair which is the NZDJPY and magtrade during Asian Session (Yellow Marker). But I am a student that's why possible na makakapagtrade lang ako during London session (Blue marker). Magstart ako tommorow using Metatrader 5 Demo Account. Yon lang goodluck sakin hahahaha peace!

Attachments

-

You do not have permission to view the full content of this post. Log in or register now.