Answer

Step 1

1.

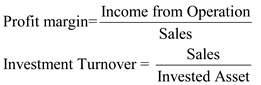

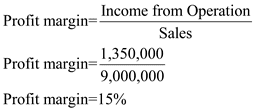

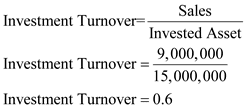

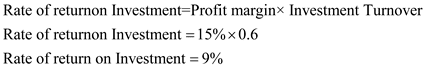

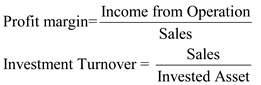

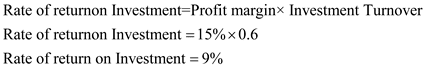

According to DuPont Formula, rate of return on Investment is determined by multiplying

the Profit margin by Investment Turnover.

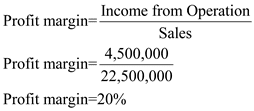

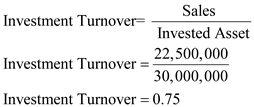

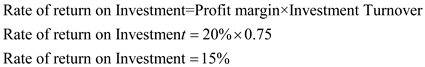

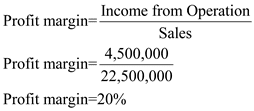

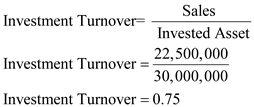

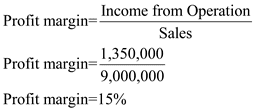

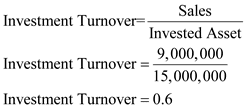

Rate of return on investment for apparel division based on income statement was:

Rate of return on investment for apparel division based on income statement was:

,

Step 2

2.

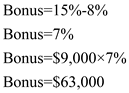

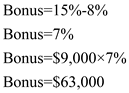

Manager’s bonus of A Division:

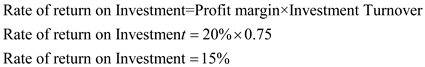

Casual Living Inc.’s overall ROI was 8%

Apparel division’s ROI was 15%

Bonus is $9000 for each percentage of exceeded Company’s overall ROI.

As it exceed, we have to calculate manager’s Bonus as

,

Step 3

Bonus for A Division’s manager is $63,000

,

Step 4

3.

Rate of return on investment for new product line based on income statement was-

4.

The manager of apparel division decided to reject the new product line because he may feel it will reduce his bonus. But it will not reduce his bonus value instead of it will increase his bonus value as it ROI was exceeded than Company’s ROI (8%).

Increase in bonus of new product line-

5.

Explanation:

Alternative performance measures for motivating division manager’s to accept new investment opportunities can be

Balance Scorecard and

EVA.