- Joined

- Oct 7, 2019

- Posts

- 434

- Reaction

- 160

- Points

- 211

U.S. debt is growing rapidly.

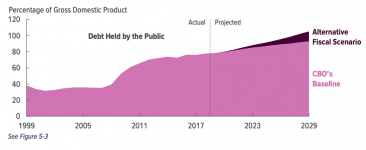

The amount of public debt owed by the U.S. government is now more than $22 trillion. This is the highest it has ever been and as the debt rises, the government continues to spend and tax revenues continue to fall. “Despite being in the second-longest economic expansion since the post–World War II boom, the U.S. is projected to rack up annual deficits and incur national debt at rates not seen since the 1940s,” reported You do not have permission to view the full content of this post. Log in or register now.. In fact, in its “You do not have permission to view the full content of this post. Log in or register now.,” the Congressional Budget Office reported that “Other than the period immediately after World War II, the only other time the average deficit has been so large over so many years was after the 2007–2009 recession.”

“By 2029, debt is estimated to reach $28.7 trillion,” said the You do not have permission to view the full content of this post. Log in or register now.. This is in addition to the current $5.5 trillion debt that the government owes to itself via You do not have permission to view the full content of this post. Log in or register now..

Rising debt is also a global problem.

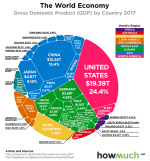

According to You do not have permission to view the full content of this post. Log in or register now., Japan’s public debt is nearly $12 trillion, China’s is over $9 trillion, the UK is $3.5 trillion, and so forth. The bottom line is that this level of debt is growing worldwide and is not sustainable.

In February, Federal Reserve Board Chairman Jerome Powell told Congress that, “You do not have permission to view the full content of this post. Log in or register now.” He also noted that, “You do not have permission to view the full content of this post. Log in or register now.”

Although the Fed chairman has publicly testified to the unsustainable nature of this massive public debt, there doesn’t seem to be any movement to solving the problem. Instead, politicians from both parties seem to be moving in the opposite direction. Republicans in Congress and the White House have passed massive tax cuts and increases to defense spending. Democrats in Congress are pushing for their own increased spending through approaches like the New Green Deal. Given the national debt situation, this doesn’t make sense, unless there’s a plan that we don’t yet know about.

Introducing a new world reserve currency.

You do not have permission to view the full content of this post. Log in or register now. describes a reserve currency as “You do not have permission to view the full content of this post. Log in or register now. that is held in significant quantities by governments and institutions as part of their You do not have permission to view the full content of this post. Log in or register now.. The reserve currency is commonly used in international transactions, international investments, and all aspects of the global economy. It is often considered a You do not have permission to view the full content of this post. Log in or register now. or You do not have permission to view the full content of this post. Log in or register now.. People who live in a country that issues a reserve currency can purchase imports and borrow across borders more cheaply than people in other nations, because they do not need to exchange their currency to do so.”XRP is perfectly positioned to serve as a world reserve currency. It can be held in significant quantities to provide liquidity for foreign exchange reserves, international transactions and investments, and all other uses throughout a global economy. In an earlier article (You do not have permission to view the full content of this post. Log in or register now.), I quoted Ripple Labs’ co-founder Arthur Britto, who wrote, “XRP must be scalable to accommodate 7.5 billion people.” Does this mean that it was designed to be used by every human on the planet and to serve as a world reserve currency? Yes and yes.

Let’s look at XRP’s ability to scale. At its creation, a total of 100 billion XRP were created. No more can ever be created, so it is deflationary in nature. Setting aside the fact that some of these XRP have been burned or lost, 100 billion XRP at a $10,000 value per XRP would provide $1 quadrillion in total value. This is enough to easily account for the $244 trillion global debt (You do not have permission to view the full content of this post. Log in or register now.), as well as $88 trillion global GDP (You do not have permission to view the full content of this post. Log in or register now.).

By its very nature, You do not have permission to view the full content of this post. Log in or register now., with fast transaction and settlement times. It is also inexpensive to use. If it is used as a de facto reserve currency, there is no need to exchange it for fiat currency, though this is also easy to do across multiple currencies and payment networks via the You do not have permission to view the full content of this post. Log in or register now.(ILP).

So, what is the secret that the politicians, non-governmental organizations, and major financial institutions might have been hiding from us?

XRP will be a world reserve currency (and it will be used to pay off debt).

It will solve the debt crisis without devaluing fiat currencies. For example, the U.S. government (and other governments) could buy XRP at very low OTC rates, which wouldn’t drive prices up on the retail exchanges. Likewise, major financial institutions could also stock up on XRP at extremely attractive prices. When all systems, policies, and agreements are in place, they simply announce that XRP will serve as a reserve currency. This drives utility and demand, which rapidly increases the price of XRP. The governments could then settle their debts using XRP, which would not devalue their fiat, because they would not be printing any additional dollars or other fiat currencies.This would explain why the U.S. administration, the IMF, and the World Bank have been so positive about Ripple Labs, xRapid, and XRP. It would also explain why the SEC and other federal agencies have not yet weighed in on XRP’s status as a security or other type of asset. It would also explain why the price of XRP has been very steady at a low price for more than 15 months, despite a constant stream of positive news about partnerships, production deals, and so forth.

My prediction is that we will see such an announcement within the next 24 months, followed by significant, sustained price growth for XRP over the course of a decade or more.

Attachments

-

You do not have permission to view the full content of this post. Log in or register now.