Farming of LP Tokens or Liquidity Pool Tokens are new to some cryptocurrency investors and traders. It is one of the good investment strategies for investors to understand. It creates a dual savings-like profit where two tokens are harvested at the same time. But what are liquidity pools and how to earn from them?

LP Tokens Basics

LP tokens or short for Liquid Pool Tokens use pair of cryptocurrencies to facilitate trading purposes. LP Tokens that were staked are bounded by smart contracts and they can be redeemed or pullout anytime.

Binance Liquidity Pool

Binance Liquidity Pool

On Binance Liquidity Pool, staked assets are the liquidity provider for the trading pair, the majority of the token pair on Binance Liquidity pool are stable crypto tokens and fiat currency. Profit from the liquid pool is made from trading fees of the chosen liquid pool pair. Asset used for liquidity pool can be redeemed any time to user's spot wallet.

To Add assets on Binance liquidity pool. Choose the pair you want and choose either both currency or one currency that will be used for liquidity. If both currency is added for the liquidity, you must have balance on both currency on your spot wallet. ROI on liquidity pool is based on traders trade size for pair currency. It is better to invest a pair of currency in the liquid pool to lessen the fees for wí†hdráwal or redemption.

The Liquid Pool Farming

There are other liquid pools for cryptocurrency pairs for investment besides Binance Liquid Pool. But be careful for fake liquid pool farming outside Binance. Always do-your-own-research before investing in such liquid pools and farms. Mostly, look for Binance endorsed pools like You do not have permission to view the full content of this post. Log in or register now., You do not have permission to view the full content of this post. Log in or register now., You do not have permission to view the full content of this post. Log in or register now., or You do not have permission to view the full content of this post. Log in or register now..The Bakeryswap

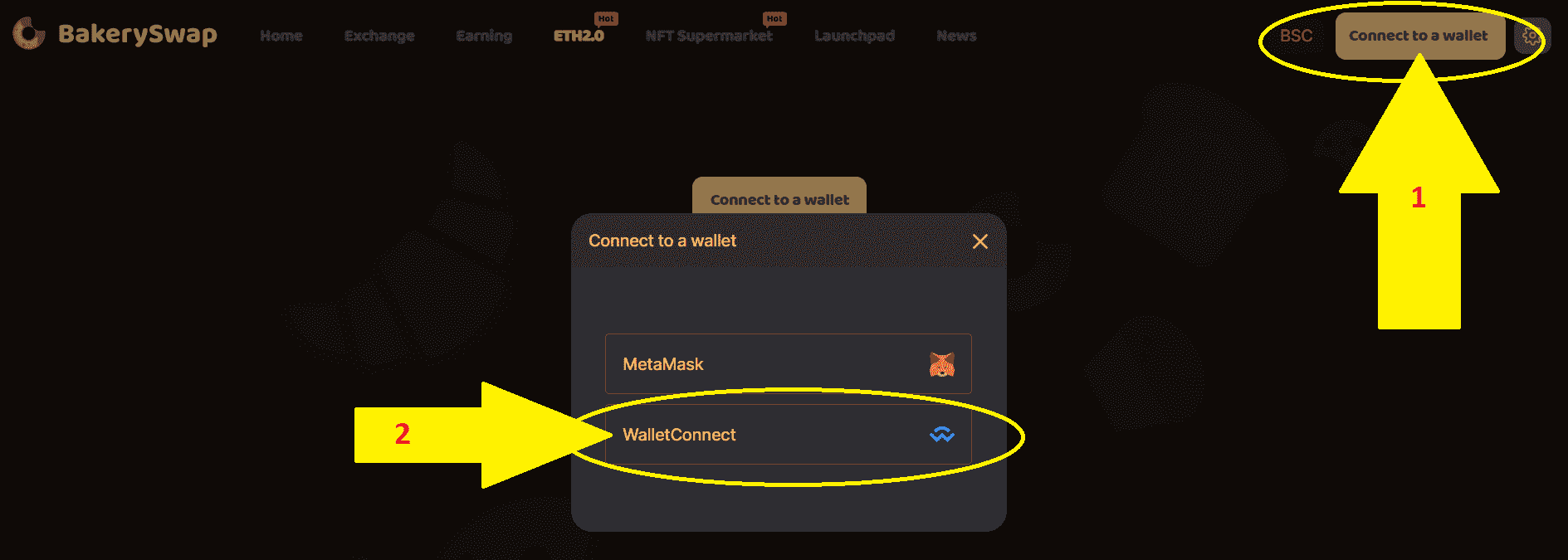

This is a guide for liquidity pool tokens on how to use Liquidity Pools to farm tokens outside the Binance platform. The wallet used for the LP Token Investment is Trustwallet. Token BETH + BNB pair is used.Step 1:

wí†hdráw BETH and BNB from Binance account to Trustwallet using Binance Smart Chain Network. Connect your Trust wallet on You do not have permission to view the full content of this post. Log in or register now. by using WalletConnect and scan the QR code using Trustwallet on your mobile application.

Step 2:

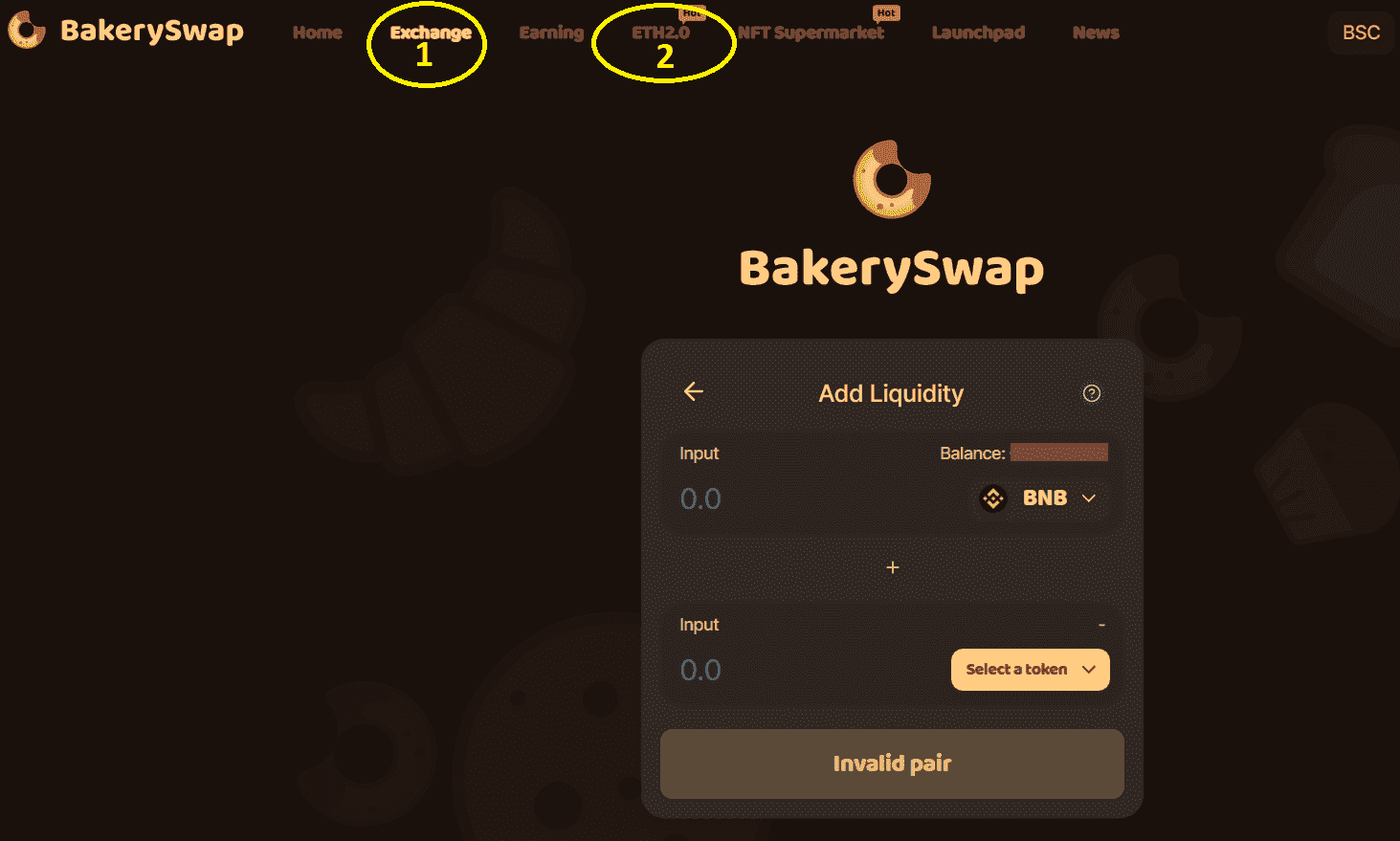

Hit Exchange tab.

Step 3:

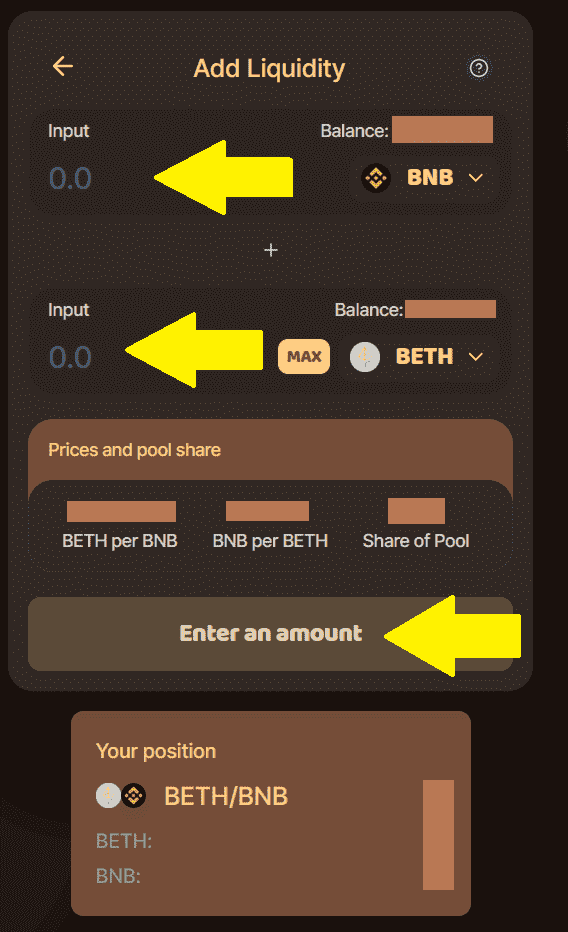

Choose BETH and BNB for liquidity pair. Then input amount of BETH and BNB respectively. After entering the amount of BETH and BNB, hit the Enter Amount and a pop-up window will open for confirmation to use asset on liquidity pool.

Step 4:

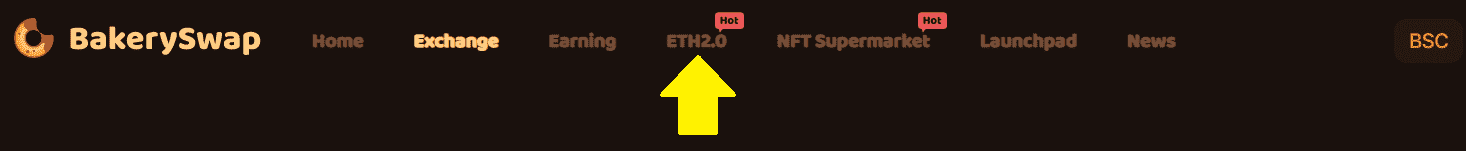

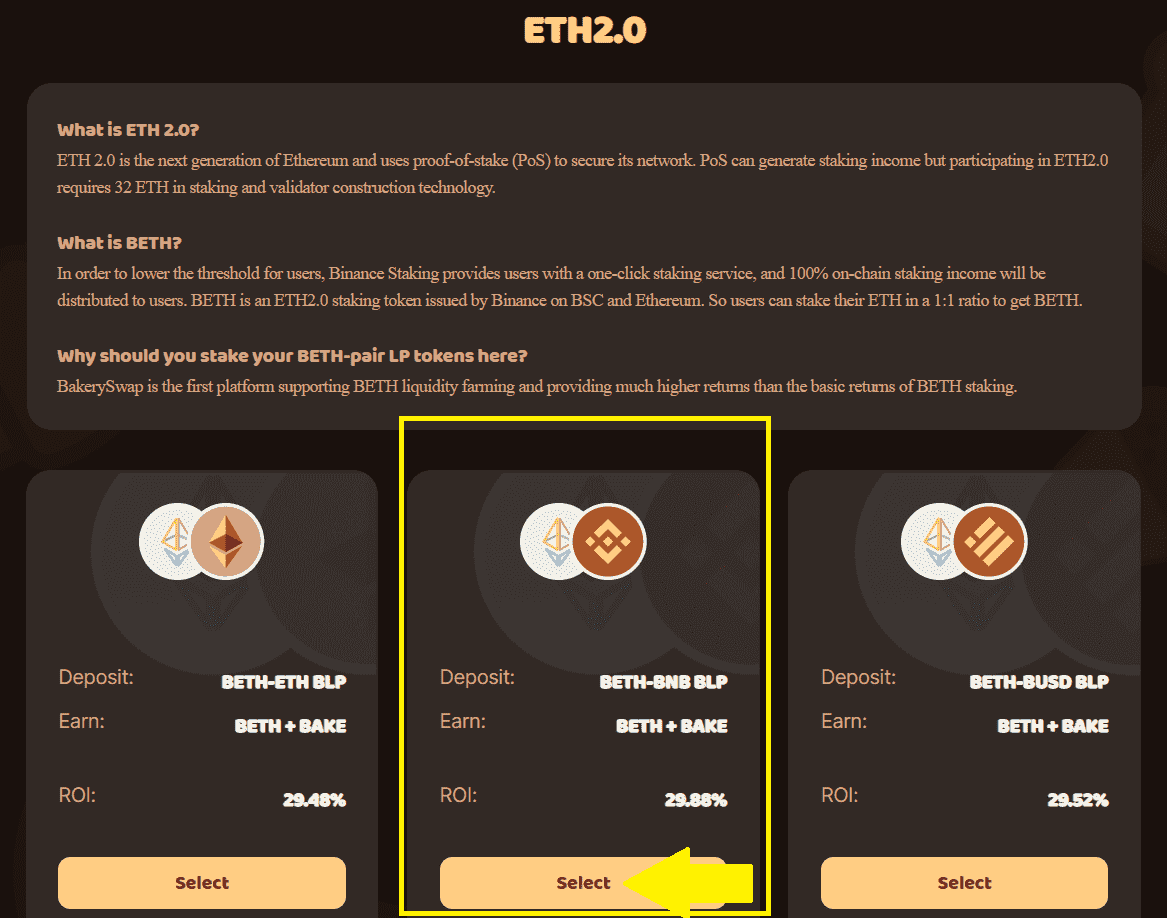

Go to ETH 2.0

Select the liquidity pool base on the pair you choose.

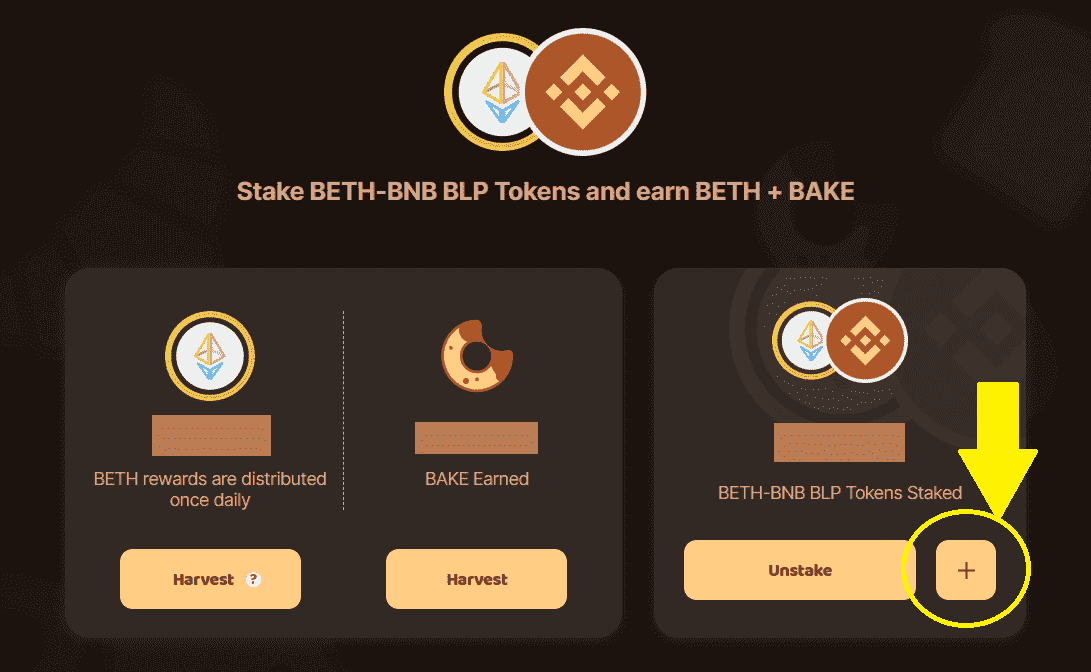

Hit the Plus sign and select amount of staking.

Pop-up confirmation will appear for the transaction used.

Investments on Liquid Pool can be redeemed or Unstake anytime. Interest of rewards are daily and can be harvested anytime.

See the whole post You do not have permission to view the full content of this post. Log in or register now.:

See Binance Blog about BETH LP Staking You do not have permission to view the full content of this post. Log in or register now.

No Binance Account yet, You do not have permission to view the full content of this post. Log in or register now..

Attachments

-

You do not have permission to view the full content of this post. Log in or register now.

Last edited: